Apartment Shortage Within The Next 12 To 18 Months Across Australia

What is really happening in the Australian property market?

As a result of a number of market forces, I believe we will face a shortage of apartments across Australia in the next 12 to 18 months.

What gives me this belief?

I buy development sites for some of the largest developers and for property funds across Australia.

During meetings with key team members at these companies, a recurring talking point has been the substantial increase in the costs of materials to build apartments and the direct increase in labour costs from builders, plumbers, electricians and other tradies which have also risen.

How much? Between 15% and 30% from the middle of covid lockdowns.

How is this a problem?

It is a question of supply and demand; currently, there is a high demand for materials, however, due to COVID measures that were implemented globally, we now have a deficit in supply.

This is a direct problem for Australia because we import most of our products to build apartments from overseas.

To put this problem into real-life context:

I was on a zoom call this week with a leading Melbourne developer and a property fund and the developer said he received a quote from the builder to build 300 plus apartments and it was 25% to 30% over budget – meaning it was 25% to 30% more expensive than they expected and were used to paying.

What do the rising costs in materials and labour mean?

Well, for example, let's say the developer above buys the land at $30M and goes to the council to get approval to build the 300-plus apartments.

Next, he then gets a quote from the builder to build the apartments, and then the developer can sell the apartments to the market for an approx. min 20% profit, after costs.

If the gross realization (meaning the final sales price for the apartment) is equal to or less than the costs of the land plus the construction costs to build the apartments, then there is no profit and the developer cannot build the apartments as it will not be economically feasible.

In this scenario, the land that the developer owns at the moment is worth nothing but its sale value because he can’t do anything with it.

This is the stark reality for developers all over Australia right now

Developers normally would have a pipeline of development sites lined up…

- From buying the land,

- Drawing up plans to build a certain number of apartments on the land,

- Seeking council approval,

- Once approved, they go ahead and start to build the apartments.

It’s important to understand the degree of planning, preparation and time that goes into these developments.

A developer can have anywhere from 500 apartments a year, to 10,000 apartments coming through their pipeline, and it is planned for many years into the future.

The process, from start to finish, can take anywhere from 2 years for smaller developments and up to 7 years or longer for larger developments.

It is a lot of work and time for the developer who has to navigate through many years of changing markets to make a minimum of 20% profit – throw in something cataclysmic like COVID and there are big problems on the horizon to navigate.

The risk over reward is substantial, not to mention the stress that comes with the job.

So why will there be a shortage of apartments in 12 to 18 months I hear you say?

Currently, due to the above points, developers have a very limited supply of apartments coming through their pipeline.

This is partly because it is harder to be profitable with existing stock due to the rising costs of materials and labour.

Additionally, it is not sensible to buy new development sites because they cannot build new apartments and sell them for a profit.

The problem is circular.

Therefore in 12 to 18 months’ time, developers will be running out of apartments to sell, ergo, whatever apartments remain will have their prices go up.

This is economics 101 when considering supply vs demand and how that relates to prices.

There are developers who were planning to start building apartments around the country who’ve instead delayed building until material and labour costs come down.

This is so they can be profitable and remain in business.

Another major factor that will drive up the prices of apartments is immigration:

- The return of international students,

- Continuing interstate migration (especially to Queensland) and

- The first home buyers preference of buying apartments instead of houses/land for affordability.

The past few years have seen a sharp decline in immigration due to COVID border closures and an exodus of international students.

The new labour government has announced it is actively seeking to raise the level of skilled immigration, with a forecast target of approximately 200,000 new arrivals per year.

It is not uncommon for immigrants to live in apartments all around the world, as a result, I expect this to increase demand and drive-up apartment prices across the country.

Also, as the interest rates continue to rise to help curb inflation your borrowing power (buying budget) becomes less to purchase real estate.

Worth noting regarding interest rates:

- The RBA’s 30-year average cash rate is 4.10%,

- The 20-year average is 3.33%,

- The pre-COVID 10-year average cash rate was 2.56% and

- The Current RBA cash rate is 1.85%.

This simply means that interest rates are still the lowest they have been when looking through the scope of time.

What do I suggest you do to benefit from the shortage of apartment stock inbound over the next few years?

Currently, apartment prices are sitting steady and there are developments that have finished with brand new built apartments for sale, which have yet to be sold, as a result of the past few months of interest rate rises which have spooked the buyers.

There are only a small number of off-the-plan developments that are going ahead compared to when the developer’s pipelines were full steam ahead.

So, I suggest that you buy an apartment now or in the next 6 to 12 months while prices are stable or correcting, and then in 12 to 18 months you will benefit from a potential increased capital gain.

If it is an investment property, remember that your rental returns will continue to go up as people have to rent if there is an undersupply of dwellings across the country, which is already happening.

Also, if you’re buying an apartment to live in or invest in there is more choice now than there will be in 12 to 18 months’ time – so the sooner you take action, the more advantageous it will be for you.

The only city I have seen where off-the-plan sales have been going up rapidly in value is Brisbane and they are selling out in as little as a few months, which has never happened in Brisbane’s history.

Good quality apartment stock in Brisbane is very limited and the housing shortage they are facing is incredible.

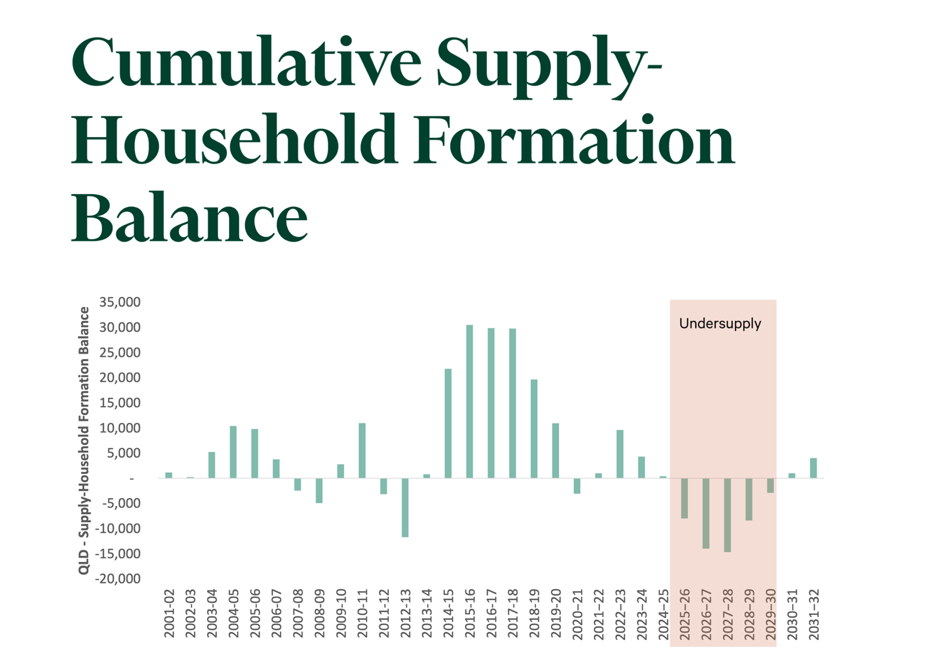

Please see the attached graph that shows you the massive undersupply right up to the Olympics in 2032.

You have 12 to 18 months, so I suggest if you’re in the market to buy an apartment to live in or to buy an investment property for your portfolio, get your loan in place or if you are cashed up, take action and buy an apartment before you miss out.

If you would like a FREE copy of my book “How to Safely Own 5 Properties in 10 Years and Retire” please visit www.michaelkellybuyersagent.com.au and download your free copy.

Michael Kelly - Licensed Buyers Agent, Author and Strategist (LREA).

Disclaimer: My writings are not to be considered financial advice. They are opinion pieces based on my personal and professional experiences. Please seek financial advice from a registered financial advisor.

This article first appeared on the B4REAL blog.

.jpg)