What Is Real Estate 3.0?

Why is blockchain going to disrupt the real estate industry and usher in Real Estate 3.0?

In ancient times, the home was the place where people would gather, children would grow and safety could be obtained.

As we evolved technologically and economically, real estate became vehicles for investment, allowing savvy investors to create substantial wealth.

Yet fast forward to modern times and one of the problems that are facing Australians is the problem of 'affordability'.

The OECD’s price to income ratio index shows a 78% increase between 1980 and 2015 - and as of 2022, the disparity can really be felt, especially in the millennials demographic.

Back in the 1980s, the median income was ~$15,800 and the national average house was ~$40,000 - meaning house prices were roughly 2.9x the median income rate.

This brings us to an important crossroads because the market forces that have had prices increase unequally compared to income growth, which in themselves would require an entire essay, demand innovation, adaption and change.

The Case For Blockchain & Crypto In The Real Estate Industry

In 2008 the world saw the release of a blueprint for a new form of currency - 100% digital money that has become the perfect definition of modern Sound/Hard Money.

It had an unchangeable finite supply (21M), a programmed release schedule with progressive reduction built into it that projects all 21M of the total supply will be circulating by the year ~2140, and importantly, a consensus mechanism that prevents fraud or double spending - a problem that plagued digital currencies since the idea was first conceived.

This blueprint was for the blockchain protocol called Bitcoin, which you may have heard of by now.

Fast forward to the year 2022 and you will see:

- BTC averages a ~$796M market cap;

- The global crypto market is averaging ±$1.6 Trillion USD;

- Daily trading volume exceeds $100B;

- There are 7,800 different tokens in the market;

- ~300M crypto holders globally;

- ~5M crypto holders in Australia (~2M of which see crypto as the path to real estate ownership according to Yougov/Luno surveys);

- And exciting blockchain/crypto companies moving into various industries to assist in digital transformation.

So what is blockchain and why should you care?

Blockchain provides an immutable, efficient and secure way to record information and transfer value between two parties.

Some of the benefits are:

- Reduction of time for transactions to be complete;

- Removal of inefficiencies as certain aspects of a deal are automated;

- Reduction in fees due to democratisation of information and certain functions;

- Programmability eliminating inaccuracies and friction;

- Opening markets to new buyer demographics.

Blockchain commands trust and security as a decentralised technology.

How will blockchain technology disrupt the real estate industry?

As technology continues to evolve, legislation and regulations will also adapt to the times. The disruption of the real estate industry may cover many areas.

1. Accumulating Savings & Making Purchases

The Problem:

As mentioned earlier in this report, affordability has become a real concern for the average person.

The Solution:

According to surveys conducted by Kraken, roughly 1 in 5 Australians see crypto investment as the best path to homeownership - this is due to savvy investors being able to accumulate significant returns on investment, which enables them to purchase real estate, just like 23-year old Loi Nguyen did recently in Brisbane.

It doesn't just stop with generating funds for deposits or full purchases, soon people will be making payments using their digital assets, via platforms like ours, B4REAL.

Currently, the process of buying and selling real estate with crypto is tricky and time-consuming, which is why we created B4REAL to fill the void and enable buyers to pay in their desired crypto, get connected with our crypto-friendly lenders for the balance of funds, and sellers are able to receive settlement in their desired currency; such as AUD.

This is the future of real estate, seamless integration with the blockchain/crypto markets for easy payments.

2. Tokenization Of Real-World Assets

The Problem:

Illiquidity, access for a diverse demographic of investors and speed of transactions can be a problem in traditional real estate deals.

The Solution:

Tokenization is a significant paradigm shift that allows assets to be traded much like equities on an exchange, and transactions may be completed online.

This allows sellers to tokenize assets, like real estate, essentially handling it like a stock sale, and liquidating that asset through a token sale using new-age platforms like ours will in the future.

The tokens may be traded for domestic fiat, such as AUD, with buyers obtaining a share in the property.

This is exciting for a number of reasons:

- It transforms traditionally illiquid assets like real estate, into liquid assets via smart technology;

- It removes borders and easily creates a global pool of investors that can enter/exit deals in a fraction of the time, costs and effort that would usually be required; and

- Automation can be built in that instantly distribute revenue generated by the assets (daily/weekly/monthly/quarterly) to the holders of the tokens based on the percentage they own, after expenses are automatically deducted.

This is the future of real estate; seamless integration with the blockchain/crypto markets for easy payments and widespread accessibility - something we are very excited to be involved with and helping real estate professionals to adopt.

3. Ownership Records & Conveyancing

The Problem:

Some of the friction points currently come down to accessibility, time consumption and manual processes.

The Solution:

One of the core functions of blockchain technology is the storing of data in highly secure 'blocks' and the transfer of value - without 3rd party intervention.

The true beauty here is that as time goes by, we will likely see all the relevant data regarding properties brought onto blockchain tech which will enable the fluid storage and transfer of ownership rights to a property.

What could this look like?

Imagine having every relevant piece of data related to a property, stored in a token, that represents not only ownership of the said property but also all historical information about the property too.

Imagine this:

- It is linked with respective government bodies so that when a sale occurs;

- It is as simple as transferring the token that represents the property from the seller to the buyer;

- With a 3rd party like a lawyer being an additional digital signature in the transfer for added security if required;

- Taking less than 10 minutes to complete; and

- With automation built in to register the sale with respective government bodies and automatically submitting all required data to the parties that need it as soon as the token arrives in the buyer's wallet.

This will reduce costs, decrease margins of error and make transaction times infinitely faster!

Note: Worth mentioning here is that this particular level of disruption still requires deep thought in regards to implementation to ensure protection from unnecessary risk, unneeded complexity being added to the existing protocols and proper integrations with respective local government bodies.

4. Involvement Of Intermediaries

The Problem:

High fees, time-consuming and error-prone manual processes.

The Solution:

Brokers, lawyers, and banks have long been an essential component of the real estate market.

According to a study by Deloitte, however, blockchain may soon shake up their functions and involvement in real estate deals.

A key attribute of blockchain technology is transparency and the democratisation of information, which means as we put more data into blockchain tech, the average person will be able to do even greater due diligence, at their own pace, in their own time.

In our opinion, this won’t remove certain intermediaries from real estate transactions, instead, it will likely:

- Reduce their workloads;

- Streamline tasks that need to be completed;

- Reduce margins of error with intelligent automation; and

- Allow for reduced costs due to less labour for the completion of tasks.

You can program all aspects of a sale, from start to finish into blockchain tech, effectively making everyone's lives easier and making the process less time consuming and costly.

5. Foreign Investment

The Problem:

Currently, the process for foreign investors getting involved in new markets is filled with friction, chief among them is the headache of sending money across borders - something that is slow and filled with fees.

The Solution:

Making a payment with cryptocurrency immediately remedies this problem by allowing instant, low cost, borderless payments.

This means, for example, a family in India:

- Who are interested in the Australian market;

- Can put their wealth into crypto;

- Send it to a trusted escrow wallet (Like we do with B4REAL); and

- Have the funds available within 10 minutes;

- So they can focus on what property they wish to buy and not worry about getting their money out of India and into Australia.

This is a tremendous improvement and a big win for all people wishing to purchase real estate abroad.

6. Evolution Of Lending

The Problem:

In traditional lending circumstances, certain buyers will be excluded due to not meeting pre-set qualifying criteria - in turn, excluding them from the real estate market.

The Solution:

Finally, the way that people secure finance for purchasing real estate will inevitably change with the onset of DeFi (Decentralised Finance), where they may be able to access standard crypto secured lending by large institutions or even more radical forms of lending such as crowd-sourced, peer to peer (P2P) lending.

What this means is that in the very near future, it could look like this:

- Buyers may be able to put down a deposit on a property with one form of cryptocurrency;

- Take out a loan using another form of cryptocurrency; and

- Then settle the loan and pay the balance of the purchase price using yet another form of cryptocurrency or just the regular domestic currency such as AUD.

This would streamline the process, decrease settlement times and make real estate more accessible to buyers who may not have had the ability to purchase in the past.

Worth mentioning here is that we have top tier lending partners who are excited about real estate 3.0, are willing to work with crypto and have their policies for doing so, which means as more people use crypto for their purchases, securing the balance as a mortgage is now a lot more simple.

7. Fractional Ownership

The Problem:

As mentioned previously, affordability and accessibility for certain buyer demographics makes it near impossible for them to enter the real estate market.

The Solution:

Blockchain lowers the barriers to real estate investing by allowing relatively easy fractional ownership. Often, purchasing property requires the payment of a large sum of money, with fractional ownership, this barrier is removed.

Some benefits of fractional ownership include:

- Investors may band together to acquire larger-ticket real estate.

- Investors would just need to use a trading app to buy and sell any amounts of tokens, as desired, thanks to blockchain.

- Fractional ownership could also assist them in avoiding the responsibilities of managing properties, such as maintenance and leasing.

Additional implications of using blockchain to facilitate fractional ownership are:

- Market democratisation: By removing the high entry prices to the real estate market and elimination of international borders, blockchain-based fractional ownership allows buyers from all over the world to participate in real estate investment, effectively democratising it.

- Easier liquidity: blockchain fractional ownership would enable easier liquidation as compared to actual physical assets, allowing simple entry and exit for investors.

- Increased transparency: blockchain-based fractional ownership can make the real estate market more transparent to everyone involved, from buyers and sellers to landlords, renters, and service providers.

As we release the B4REAL platform in stages, fractional ownership of real estate assets is an exciting stage that we can’t wait to release to the Australian market.

How does B4REAL fit into the picture?

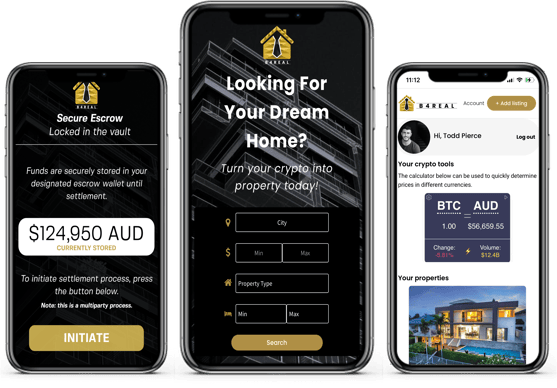

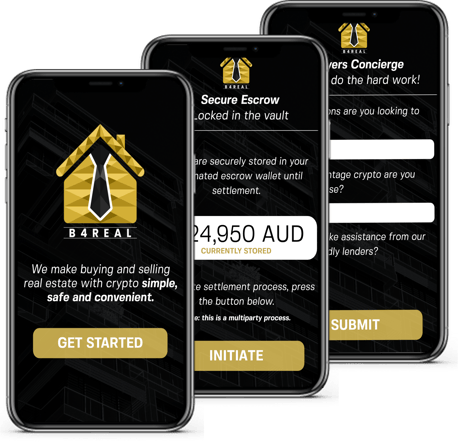

The B4REAL platform has the core functionality of facilitating real-world land and property transactions involving digital wealth.

We achieve this with an integrated systems approach, combining:

- An easy-to-use marketplace for connecting buyers and sellers;

- Escrow wallets for confidence and security;

- Our AUSTRAC registered digital currency exchange for smooth transactions (Buyer pays in Bitcoin and sellers receive AUD, as an example); and

- Our blue-chip partnerships in lending, legal and accounting for accelerating adoption and ease of funding for buyers.

Worth mentioning also is that via our existing partnerships alone, we have 25,000 listings committed to our platform per annum.

We do 3 core things for our users:

- Connect sellers and motivated buyers;

- Take care of the complicated and risky elements of the transactions so that buying or selling real estate with crypto is simple;

- Provide the framework and platform to enter the new digital wealth economy with ease.

B4REAL Platform | Today

As of the time of writing this blog, B4REAL already can do some pretty cool stuff...

- Currently in MVP (Closed beta);

- Can list properties;

- Contact between sellers and buyers;

- Facilitate safe and secure escrow of funds;

- Deliver settlement in any currency sellers desire with our AUSTRAC registered DCE creating transaction fluidity;

- Allow access to our strategic partners;

- Buyers / Seller Matchmaking Concierge; and

- Step-by-step agents manual for compliance, safety and convenience.

B4REAL Platform | Tomorrow

As we continue down our development path, the B4REAL platform will evolve into the only tool you use for anything to do with crypto/real estate transactions.

- Integrated lending solutions;

- Integrated accounting solutions;

- Access to a global pool of thousands of motivated buyers holding substantial digital wealth;

- Fractionalised ownership investment opportunities via tokenisation;

- Robust end-to-end application for listing properties, tracking outcomes, finding buyers / sellers and handling every aspect of crypto-centric real estate sales.

Conclusion

The complete digital transformation of the real estate industry with ground-breaking modern tech is going to open up new markets, create accessibility to people who previously were disenfranchised and make the buying and selling experience simple, convenient and streamlined for buyers, sellers and real estate professionals.

If you haven't already, some B4REAL resources are here:

Our lite paper: DOWNLOAD

Our limited seed round opportunity: VIEW HERE

Our website: CLICK HERE

.jpg)